What Tax Service To Use For 10-99

I've been using TurboTax for the past 14 years and have enjoyed finding the best discounts for TurboTax each yr. You might have noticed an area where you can enter a "TurboTax service code" during checkout. However, yous actually don't demand to blazon in a service lawmaking to get their latest deal, where yous tin save up to an additional $10- $20 on TurboTax. You lot just accept to brand sure you through the correct promotion folio showing the discount.

Simply if you nonetheless desire to compare the latest deals, I've organized the top TurboTax service codes, offers, and TurboTax coupon deals into a reference listing. Below are the best Turbotax coupons for 2020 and 2021 I've been able to find online.

Limited time only. Valid Dates posted on TurboTax above

Table of Contents (Quick View)

- TurboTax Service Codes & Deals for 2021-2022

- TurboTax Discounts – Quick View Table

- Bank of America, AARP, USAA TurboTax Discounts

- TurboTax Product Pricing Information

- What is a TurboTax Service Code?

- Is TurboTax Really Costless?

Top 10 TurboTax Service Codes

(from 2020, 2021, and 2022)

1. TurboTax for Military machine – TurboTax has long offered a disbelieve for the armed services. In fact, you tin can file for free for simple tax returns only if you are a service member in ranks E1-E5. If you need the premier features, you are eligible for a discount equally well.

two. Student Discount TurboTax – Whether you are a grad student or an undergrad, you lot can save money on TurboTax or with the other versions using the latest discount. Every bit of now, information technology's $10 off depending on the selection you select.

3. Costco TurboTax Deal – If you are a fellow member at Costco, you can save money this year when you purchase TurboTax in the shop. Combine your buy with the latest promotional bargain from Costco for new members (a $ reward) and utilise that towards TurboTax for an even sweeter deal!

iv. Uber or Lyft TurboTax Offers – Every bit of now, the $x off deal is still the highest discount for drivers who want to employ TurboTax. For example, if you worked as a ride share provider, yous're best off using the self-employed TurboTax selection as you lot'll exist able to take advantage of sure deductions and credits.

v. AAA Discount on TurboTax – By far the best disbelieve on TurboTax has been AAA over the by few years. Yet, this will depend on your region. For some reason, however, a higher discount is offered in certain regions just. Even if you don't qualify for a AAA discount, yous tin can nonetheless file free for simple tax returns only and use the latest discounts.

TurboTax: $10-$20 Off Eligible for: Deluxe, Premier and Cocky Employed

Back to Peak

TurboTax Discount *Update*

TurboTax is running a new promotion that offers $0 Fed. $0 Country. $0 to File for simple revenue enhancement returns. In by years, they have charged between $14.95 and $29.95 to file your land returns. But for 2022, you can file your 1040EZ/A Gratis for Federal and State with the free edition for simple revenue enhancement returns simply. I will update this page if an extension is made.

TurboTax Discount Code 2021 – 2022

About every year you can utilize a TurboTax discount lawmaking automatically by using the discounted product pages highlighted beneath. Each TurboTax discount will take off $x – $fifteen, which tin can save you virtually 15% on boilerplate.

6. TurboTax Free Edition: Discount: $ FREE $ You can use the Turbotax gratis edition to file simple tax returns (1040EZ and 1040A). Extra costs may apply for state.

7. Deluxe Edition: – Most popular selection for homeowners to maximize taxation deductions and credits.

8. Premier Edition: – All-time option for people with investments, rental backdrop, and for those who refinanced their abode recently.

nine. Self-Employed Edition – Cracking for independent contractors, freelancers, and business owners. Includes all features of palatial and premier.

10. TurboTax Canada – To our friends in the n, you can save x% on TurboTax Canada, likewise!

Dorsum to Meridian

TurboTax Service Code 2021 – 2022 & Coupons

TurboTax Service Code?

A TurboTax service code is a special code that provides a discount toTurboTax usually provided by a client service representative. They are not considered coupons, which can range from $x Off TurboTax every bit seen here.

TurboTax Service Code 2022

| TurboTax Coupon | Discount Corporeality | Expiration |

| Military Disbelieve | File for Gratuitous for eligible servicemembers | 4/15/2022 |

| Student Disbelieve | Free File for elementary taxation returns only or $10 Off | 4/15/2022 |

| Palatial Edition | $twenty off TurboTax Promotion | 1/20/2022 |

| Premier Edition | $20 off TurboTax Coupon | iv/15/2022 |

| Self Employed | Upwards to $30 Off – TurboTax Discount | iv/15/2022 |

Back to Top

TurboTax Bank of America Discount:

Depository financial institution of America has provided discounts for TurboTax in the past, but they no longer provide this discount. However, with the newest $10-xx discount applied from TurboTax, it's actually a better deal than the sometime discount from Bank of America.

* Allegiance, USAA, and Progressive Insurance are known to provide discounts for their members. However, the current discounts are commonly much better than the smaller 10-15% discount often seen with these companies.

The discounts listed above are based on the latest deals from TurboTax, almost updated 2/four/2021. Offers are bailiwick to modify and may exist discontinued at any given time. I don't see a BofA TurboTax service code 2020 or 2021 happing this year, but check back to meet if that changes.

AARP TurboTax Discount?

AARP TurboTax Discount – Every bit an AARP member, y'all can get admission to hundreds of discounts on services. Many people wonder if there's a specific AARP TurboTax discount, but they practice non offering one every bit of 2021. But that won't keep you from getting the all-time deal when filing your taxes. Y'all can still use the free file option for simple tax returns but or save a skilful percentage with the latest TurboTax service lawmaking and promotion.

USAA TurboTax Discount?

U.S. military members and USAA members can salvage up to $20 on TurboTax and may exist eligible to file completely complimentary under the TurboTax military disbelieve. While there isn't a specific USAA Turbotax discount promo lawmaking, you can file straight on TurboTax and the discount will apply if you come across the criteria based on their questionnaire. The war machine / USAA discount should utilize before you reach the final checkout page.

Back to Elevation

Which TurboTax Production Should I Utilise?

1 of the reasons I similar to utilise TurboTax is that it guides you lot to select the advisable product based on your needs. For example, if you are a student who needs a bones revenue enhancement return, y'all don't need the Premier version. For someone who owns a house and started a business on the side this year, TurboTax will guide you through the questions that help you decide between the Premier and Self-Employed option.

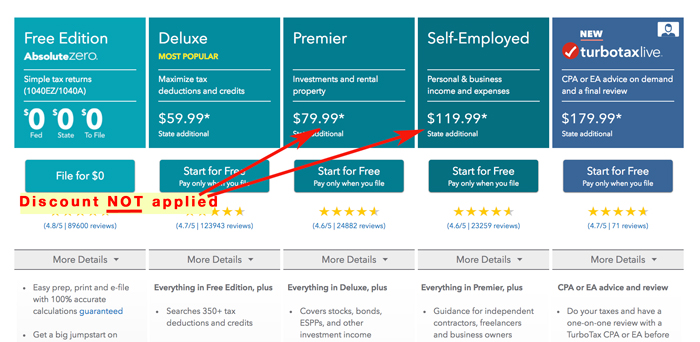

How much does TurboTax toll in 2021 and 2022?

TurboTax Plans and Pricing

TurboTax has v editions:

- TurboTax Costless (for simple tax returns only)- Price is $0 + $0 for each state return

- TurboTax Palatial – Toll is $40 + $twoscore for each state return

- TurboTax Premier – Cost is $seventy + $xl for each land return

- TurboTax Cocky-Employed – Cost is $xc + $40 for each state return

- TurboTax Alive – Cost is additional $50 to $80 per edition plus $50 for country return

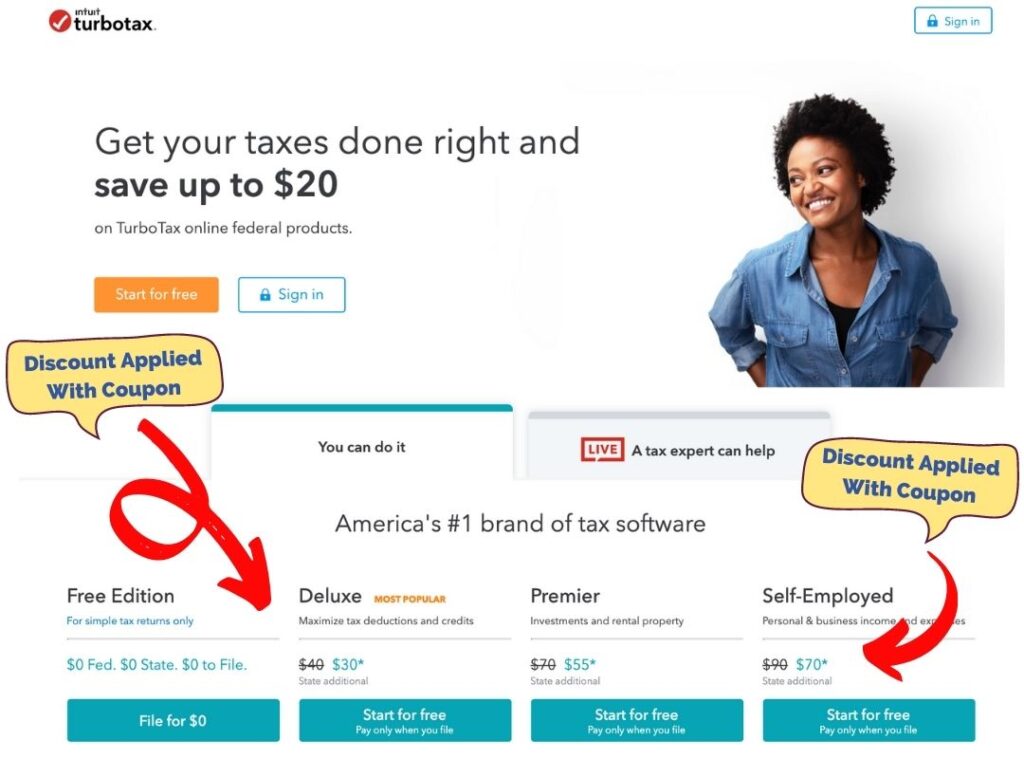

However, a $x-$xx coupon volition drop these prices to $30, $50, and $70 for the deluxe, premier, and self-employed options.

Federal Complimentary Edition

Turbotax Free Edition for simple tax returns but – Use the Turbotax free edition for simple tax returns (1040EZ and 1040A). A must for students or new grads.

$0 Fed +$0 Land For uncomplicated taxation returns merely with TurboTax Free Edition

Is TurboTax really complimentary? Yes, you tin file a uncomplicated federal and state tax return with Turbotax for free for simple revenue enhancement returns merely if you have the following situations:

- W-2 income

- Limited involvement and dividend income reported on a 1099-INT or 1099-DIV

- Claim the standard deduction

- Earned Income Revenue enhancement Credit (EIC)

- Kid tax credits

If you have educational expenses or student loan interest to claim, you'll want to employ the deluxe edition for $30.

Turbotax Palatial Edition

Turbotax Deluxe – Most Popular. This version is corking if you own a home or want to deduct your charitable donations or student loans.

Use the deluxe edition if you meet these criteria:

- Deduct student loan interest & educational expenses

- Deduct charitable donations

- Mortgage or holding revenue enhancement

In addition, the Deluxe edition volition come up with all the features of the Turbotax free edition, and searches for over 350 deductions you may qualify for.

If you're cocky-employed or own rental properties, you'll want to use the premier or self-employed option.

Turbotax Premier Edition

Turbotax Premier Edition – This version includes everything from the Deluxe and is bully for those with investments, rental properties, and for those who refinanced their habitation recently.

You'll desire to consider the Turbotax premier selection if you meet the following criteria:

- Own stocks/bonds within an investment account

- Yous have rental belongings income

- Y'all've refinanced your dwelling this past year

- Reporting gains/losses of cryptocurrency on taxes

Some investment firms tin can connect directly to TurboTax to permit easy transfer of your tax forms – super helpful if you choose this parcel.

Turbotax Self Employed Edition

Self Employed – As it sounds, this version is for people who are are independent contractors, freelancers, and business owners. This version helps you in deducting mileage, dwelling function, and business expenses.

You'll want to consider the Turbotax self-employed choice if you meet the following criteria:

- You need to file a Schedule C,

- Import expenses and vehicle mileage from Quickbooks,

- Need to report 1099-MISC income

TurboTax Alive

This newest product from TurboTax provides yous with a one-on-i review of your taxes with a tax expert. It includes the 100% accurateness guarantee.

Each version of Turbotax tin can include the TurboTax Live characteristic, connecting y'all with a tax expert for unlimited guidance to answer questions yous have.

In improver, the Turbotax Live pick provides you with year round guidance, and so you can connect with a taxation professional person someday, a really nice feature.

Turbotax Live Pricing

You volition pay a premium for this characteristic, ranging from an boosted $l to $80 depending on the plan you choose.

For a small-scale business owner who is trying to save coin only also values the expertise of a tax adept, information technology'south a surprisingly affordable choice to know a tax adept is reviewing your taxation return! Virtually accountants and tax lawyers won't answer the phone for less than $150!

Back to Top

TurboTax Coupon vs TurboTax Service Lawmaking 2022

The coupon beneath is simple because the discount is applied directly through the link.

TurboTax has fix specific pages where the coupons automatically apply. Well-nigh discounts are automatically applied when you click on a link or coupon like to this i:

TurboTax: $10-$20 Off Eligible for: Deluxe, Premier and Cocky Employed

What is a TurboTax Service Code?

A TurboTax service code applies a discount to your TurboTax product. Sometimes employers provide service codes for TurboTax. You may also become a TurboTax lawmaking from a company like AAA or USAA. You tin can add the TurboTax code directly in your cart when y'all select the product. The following $20 coupon is the best disbelieve provided.

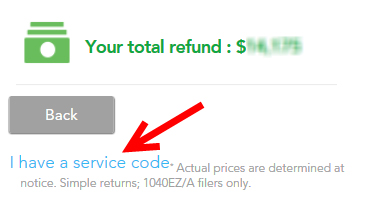

Enter your service code and click "continue"

Why isn't my TurboTax Service Lawmaking or Discount Working?

Sometimes the big-proper noun coupon sites will list out multiple 'coupons' but none of them actually pb to a page.

Other times, you may be trying to admission a TurboTax landing page through a specific offer, but cannot see the page because you are already logged in.

Fifty-fifty still, I recommend logging out of your current page with TurboTax and referring back to the discount page that you lot are trying to reference.

For instance:

- Log out of your account.

- Click on the desired TurboTax coupon link on our site

- View the new page with updated discount:

TurboTax: $10-$xx Off Eligible for: Deluxe, Premier and Self Employed

Dorsum to Top

Start Preparing Early

My best advice for those looking to file their taxes is to begin the process early. Most importantly, remember that the tax deadline is Friday Apr 15th, 2022 this year! The good news, however, is that you tin can and should kickoff your return now.

Using the $10-20 Off Coupons, head over to TurboTax and sign in while the disbelieve applies. You'll exist able to add together your tax information as it arrives and the disbelieve should nevertheless apply!

Ofttimes Asked Questions

TurboTax Service Code 2021 Reddit

In 2018 a user on Reddit posted how they were able to get a Turbotax service code of $20 because they complained about a price discrepancy. For 2022, a $ten to $20 disbelieve tin can be applied to all TurboTax products.

Is Turbotax Actually Free

Aye, you can file a uncomplicated federal and state revenue enhancement return with Turbotax for costless for simple revenue enhancement returns merely if y'all only have the following situations: Westward-ii income but, limited interest and dividend income reported on a 1099-INT or 1099-DIV , you claim the standard deduction, Earned Income Tax Credit (EIC) – Kid tax credits. Additionally, if you have educational expenses or student loan interest to claim, you'll desire to apply the deluxe edition for $thirty.

Dorsum to Top

Happy revenue enhancement filing!

What Tax Service To Use For 10-99,

Source: https://www.ptprogress.com/turbotax-coupon-discounts/

Posted by: pagerebutte.blogspot.com

0 Response to "What Tax Service To Use For 10-99"

Post a Comment